How Do You Know What Basis of Accounting

Making money-related decisions is one of the main and probably most stressful responsibilities of a business concern owner. In order to make these decisions the right style, yous demand to base them on reliable financial statements.

And a crucial stride in creating these accurate accounting books is choosing the right basis of accounting.

The ground of bookkeeping relates to the timing when transactions go recorded. The 2 bases businesses can choose from are either cash ground or accrual basis accounting.

In this article, we will explicate their characteristics and differences in detail, along with choosing the correct footing of bookkeeping for your pocket-size business.

Read on to learn about:

- What Is the Footing of Accounting?

- Difference Between Cash Ground Accounting and Accrual Basis Bookkeeping

- What Is Cash Basis Accounting?

- What Is Accrual Basis Bookkeeping?

- Should Your Small Business Use Cash Footing or Accrual Basis Accounting?

What Is the Footing of Accounting?

Every business records revenues and expenses into its fiscal statements at a specific time. This timing of documentation is known as the footing of accounting.

There are two chief types of accounting methods: cash basis bookkeeping and accrual basis accounting.

A third option is the hybrid (or modified) cash ground method, which is a combination of the two above.

The IRS allows pocket-size businesses to selection whichever type they prefer, only they must stick to this chosen method until the very end.

On the other mitt, public companies and those generating over $25 meg for iii years are obligated to use accrual basis bookkeeping.

We will explicate why as we go forth. But first, let's check out the master differences between cash basis and accrual basis accounting.

Try Deskera Books For Your Business Bookkeeping

Sign Upward For Free Trial

Difference Betwixt Cash Basis Bookkeeping and Accrual Ground Accounting

Cash and accrual accounting brand similar periodical entries, just the key difference between the two lays in the timing of recording.

Cash accounting recognizes money merely when it is received or paid. While accrual, recognizes acquirement the 2nd information technology gets earned, and expenses right when they get billed.

Listed on the table below y'all'll find a summarization of the main distinctions between the two:

Now that we got an idea of how greenbacks and accrual accounting differ, let's explicate each one in detail.

What Is Cash Basis Bookkeeping?

Cash footing accounting documents revenues simply when the coin is received, and expenses but when they get paid. This ways, at that place are no recordings of receivables or payables.

The same principle applies to taxation. In cash ground accounting, taxes get paid only when income is received.

The nigh mutual businesses that opt for cash accounting are:

- Sole proprietorships and partnerships, considering these types of ownerships don't have to publish their financial books.

- Businesses who apply single-entry accounting, instead of double-entry accounting

- Businesses with few transactions and employees

- Businesses with no inventory

- Businesses who don't sell or purchase on credit

Now, this method may be the simplest to manage, only it's not the nearly accurate. Greenbacks basis bookkeeping easily distorts the idea of how much your business concern can afford to spend.

For instance, assume the two following financial transactions occurred:

Purchase of $300 dollars of materials whose invoice arrives side by side month.

- Received $one thousand from sales.

With cash-footing accounting, your profit for the month would exist $1000, even though at that place was a $300 neb spent on materials. This tin can easily crusade the business to overspend an extra $300 they can't afford, and non exist able to pay the invoice expense side by side month.

What Is Accrual Basis Bookkeeping?

Accrual footing accounting measures a business' fiscal performance by recognizing financial transactions when they occur, regardless of when the cash exchange takes place. In simpler terms, expenses are recorded when they get billed, and revenues when earned.

For case, a finished project will be recorded every bit income for the business organisation, fifty-fifty if the client hasn't paid all the same.

This method is considered as the standard accounting practice for most companies. In fact, the law requires public businesses such as C-corporations, and those who generate over $25 million in acquirement for 3 preceding revenue enhancement years, to employ accrual bookkeeping.

But what makes accrual accounting so necessary?

Well, first and foremost, it provides a more realistic and accurate picture of finances. Information technology allows a business to realize the true profit they're making, in real-time. And so, preparing budgets and other financial plans becomes fashion easier.

This method doesn't simply affect the business'south internal controlling, however. Investors and creditors also prefer finances kept with accrual bookkeeping.

At present, although accrual accounting is more than used as an bookkeeping basis, it has its own downsides.

The process is more complex, and so it takes upwardly extra time and resource to manage. As well, it could mess up the short-term view of your finances.

For example, say y'all send out invoices worth $10,000 every month. Accrual basis shows you accept earned the cash, even if your business banking concern account is dry out and empty. This "illusion" could affect the business organisation' power to pay bills or even employee payrolls.

What Is the Modified Cash Ground Accounting?

The goal of modified cash basis accounting is to profit from the best of both worlds. This strategy combines elements from both greenbacks and accrual bookkeeping.

To be more specific, short term assets are recorded using a cash basis, while long-term ones through an accrual basis.

This approach is less costly, in comparing to full-accrual accounting.

However, information technology'southward not allowed by GAAP or IFRS, so it should be used for internal purposes simply.

Should Your Small Business Use Greenbacks Basis or Accrual Ground Bookkeeping?

Once again, as far as the constabulary is concerned, accrual accounting is merely required for public businesses, and those generating over $25 million in a three twelvemonth period.

If your small business doesn't fall under these categories, y'all're free to pick and choose any basis of bookkeeping.

With that being said, greenbacks ground bookkeeping works all-time when the business has little cash in paw and is dealing with few transactions. It prevents cash menstruation issues from crippling these operations.

On the other mitt, if y'all're the owner of a busier business with more financial activeness, information technology'due south best to go for accrual bookkeeping.

Now y'all're probably wondering, can you switch from i method to the other

Short answer, yes.

However, it'due south a lengthy process, which needs permission from the IRS to take identify. You have to add upward your accrued and prepaid expenses, subtract customer prepayments, file for a Class 3115, and make more than adjustments.

PRO TIP

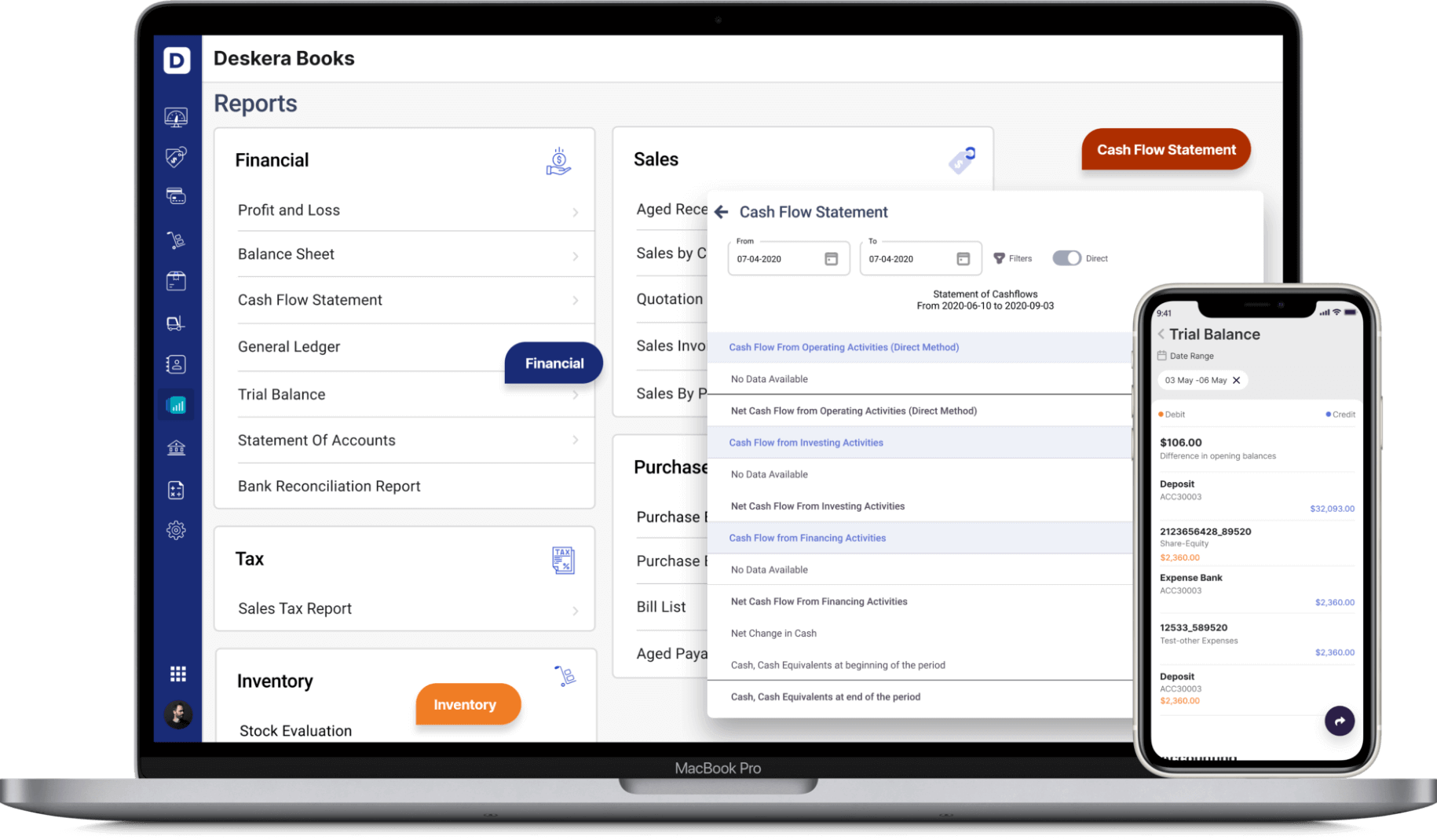

Bookkeeping software similar Deskera automates your accrual basis bookkeeping for you. By integrating straight with your bank accounts, whatever payments or purchases made become immediately posted to the appropriate ledger business relationship.

You tin also use our professional invoice creation tool to easily send and receive bills, which go automatically entered into the right payable and receivable accounts.

Not convinced Deskera is the right choice for you lot?

Well, yous can try it out yourself with our free trial! No credit menu required.

How tin can Deskera Books Help Your Business organisation

Take your concern to the next level with Deskera All-in-One. Information technology is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all nether one roof. With Deskera books, you tin keep track of your business greenbacks menstruation and revenue using its fiscal reports. Accounting tin can be easily managed Deskera Books and can help y'all keep track of your balance sheet, profit and loss statement and journal ledger. All this simplifies your accounting and tracking of your fiscal records, making information technology like shooting fish in a barrel for your business to get business credit and to secure loans.

With Deskera Books, you tin can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business organisation such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business concern dashboard apart from many other features.

Try Deskera Books For Gratuitous Today

Sign Upwardly For Free Trial

Key Takeaways

And that's a wrap! We hope our guide to the basis of accounting was helpful.

To recap, here are the principal points we've covered:

- The basis of accounting refers to the timing varieties when fiscal events go recorded.

- The two main types of bases are greenbacks basis and accrual ground accounting.

- Cash basis records finances when money exchanges hands, while accrual basis when the transaction occurs, whether or not any cash has been received or paid.

- Public businesses and those with over $25 million in revenue are required by law to use accrual accounting. Small businesses, on the other mitt, are free to choose their own basis.

If you want to learn more virtually doing accounting for your concern, cheque out our Related Guides below.

Related Articles

Frequently Asked Questions on Accounting

Whether you lot own a small-scale or large business, accounting plays a vital role in thegrowth of your business organisation. There are many questions that may cross your mind everyday related to accounting. Let's take a look at some of the often askedquestions related to bookkeeping: Who is an Accountant?An acc…

Frequently Asked Questions on Accounting Software

Accounting software is a tool that is widely becoming popular due to thebenefits it provides. However, getting to know this software can be difficultfor some people. Let's take a await at some of the often asked questionsrelated to accounting software[https://www.deskera.com/blog/accounting-software-advantages-benefits/…

Accounting Bicycle - Definition & Examples for Business organisation

If you're managing a pocket-size business, you probably don't have a lot of spare timeto deal with accounting. And equally a result, accounting becomes more of anafterthought, rather than an essential business activity. However, keeping track of your business' finances and accounting is extremelyimportan…

Common Accounting Errors - A Practical Guide With Examples

When running your own business' finances, you lot'll likely make accounting errorsfrom time to time. Even the most qualified accountants do. And although it's normal to make mistakes, it's as well essential to always noticethem and become things right. At the terminate of the day, your business concern is merely asrelia…

Accounting For Startups - The Entrepreneur's Guide

Establishing a startup can be overwhelming piece of work. And as a founder, y'all probablydon't accept fourth dimension to worry nigh sending invoices or balancing the books. Withal, it's still crucial to have some general knowledge of the fundamentalsof accounting. After all, no matter how great an thought is, it wo…

Source: https://www.deskera.com/blog/basis-of-accounting/

0 Response to "How Do You Know What Basis of Accounting"

Post a Comment